Ichiro Kawabata

Licensed real estate appraiser

Member of Japanese Association of Real Estate Appraisal

President

Kawabata Real Estate Research Institute Co., Ltd.

Mailing address; Ken-Keizai Center2F, 26, Nisimigiwacho, Wakayama City, Wakayama Prefecture

640-8227, JAPAN

Url; http://www31.ocn.ne.jp/~reap/

E-mail address; reap@bb.mbn.or.jp

1. Introduction

A few miles south of Soledad, the Salinas River drops in close to the hillside bank and runs deep

and green. The water is warm too, for it has slipped twinkling over the yellow sands in the sunlight

before reaching the narrow pool. On one side of the river the golden foothill slopes curve up to the

strong and rocky Gabilan mountains, but on the valley side the water is lined with trees."

This is a quote from 'Of Mice and Men' by John Steinbeck.

In Japan there is also an area as beautiful and sacred as this in California. We call this the

Koya-Kumano area in the Kii Mountain Range . This area was added to Unesco's World Heritage List of

"Sacred Sites and Pilgrimage Routes in the Kii Mountain Range" in 2004.

The Kii Mountain Range is located to the south of Kyoto and Nara, ancient capital cities that ruled

Japan for over 1300 years. The mountains occupy most of the area known as the Kii Peninsula, are

covered with a dense blanket of green forest and have been Japan's spiritual heartland through the

ages, a sacred place to where, it is said, the gods of Shintoism and Buddhism descended to reside.

I am a real estate appraiser in Wakayama prefecture where the Koya-Kumano area belongs. There is

Shirahama town on the south coast of this prefecture. This is nationally famous as a holiday resort

place. As of 2003, the town had an estimated population of 19,646 with a total area of 64.73 km2.

Shirahama is also known for its spa and its beautiful white beach. The main Shirahama beach is lined

with hotels like a mini Waikiki. Shirahama is about two and a half hours from Osaka by Japan Railway's

"Ocean Arrow". There are also daily flights from Tokyo's Haneda Airport. The flight is less than 1

hour. However, though this town is famous as a tourist resort, the land value standard is never high

as it belongs to the rural district in the prefecture. It is about 150,000 yen/ću at the ceiling price.

I am also in charge of the fixed asset tax evaluation in this town. Although this is a small town in

this prefecture, it is very difficult to evaluate every household.ü@Therefore we choose some standard

places and evaluate them first. The standard property points rise up to about 2,200 places.

To evaluate these many properties in a well-balanced fashion, the multiple regression analysis on the

statistics is very useful. I want to talk you about my impressions using this analysis.

2. The multiple regression analysis

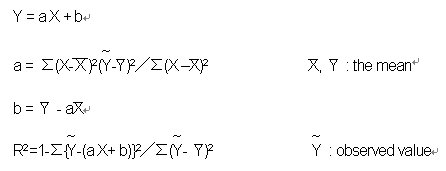

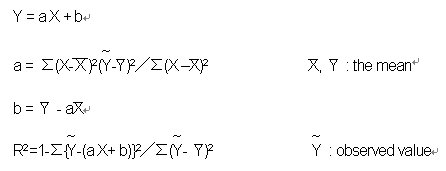

The regression analysis is one of the methods of statistics to formulate a dependent variable by other

explanatory variable (the regression equation) and to analyze each other variable's relation. The

regression equation is expressed by the least squares method to make the difference (the residual)

between the predicted values and the observed values the least. The precision of this analysis is judged

by the coefficient of determination. In other words, if the data (the observed values) has a tendency,

it will be expressed by the linear equation as the following.

Y= a X + b

There is some estrangement between the predicted values gotten by this equation and the observed values.

This estrangement is called residual. The residual sometimes shows a positive value, other time it shows

a negative one. So it is necessary for us to look into the degree of the estrangement by squaring the

residual. It is called the least squares method to get a and b of this equation by minimizing the sum of

these squared residuals.

Then what is the coefficient of determination? It is closely related with the variance which shows the

degree of the scatter which the distribution of the data has. Doing a regression analysis, the important

terms include the following.

(1)Mean : The numerical value divided the sum of all data by the number of the data is called mean.

(2)Deviation: The difference between the data itself and the mean of the data is called deviation.

(3)Variance : The numerical value divided the sum of the squares of deviation of each data by the number

of the data (or nü|1) is called variance.

If the meaning and usage of these terms can be understood, the regression equation can be set up and the

coefficient of determination can be grasped. 'a and b' in the regression equation and the coefficient of

determination can be expressed as the following.

Then what is the coefficient of determination? It is closely related with the variance which shows the

degree of the scatter which the distribution of the data has. Doing a regression analysis, the important

terms include the following.

(1)Mean : The numerical value divided the sum of all data by the number of the data is called mean.

(2)Deviation: The difference between the data itself and the mean of the data is called deviation.

(3)Variance : The numerical value divided the sum of the squares of deviation of each data by the number

of the data (or nü|1) is called variance.

If the meaning and usage of these terms can be understood, the regression equation can be set up and the

coefficient of determination can be grasped. 'a and b' in the regression equation and the coefficient of

determination can be expressed as the following.

As stated above the equation,

As stated above the equation,  is the sum of squares of the residual. The lesser this

is, the closer the coefficient of determination to 1 and the more suitable this regression equation is

for the analysis. In this way it is called the least squares method to seek the regression equation as

the coefficient of determination is closer to 1. The multiple regression analysis is this application.

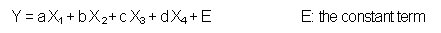

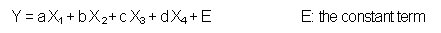

In this simple regression analysis the explanatory variable is only one but in the multiple regression

analysis the variables become more than one. The multiple regression equation is expressed as follows. is the sum of squares of the residual. The lesser this

is, the closer the coefficient of determination to 1 and the more suitable this regression equation is

for the analysis. In this way it is called the least squares method to seek the regression equation as

the coefficient of determination is closer to 1. The multiple regression analysis is this application.

In this simple regression analysis the explanatory variable is only one but in the multiple regression

analysis the variables become more than one. The multiple regression equation is expressed as follows.

3. The gap rate

When we appraise a piece of real estate, we must analyze the value influences of the real estate. Above

all, while performing an analysis of the subject neighborhood, we must grasp the market-specific value

influences and quantify them numerically. The quantitative analysis is expressed as the gap rate of the

market-specific value influences which are useful to apply the appraisal approach, especially the sales

comparison approach.

The land value is generally considered the product of various value influences. Value influences are

divided into general value influences, market-specific value influences and property-specific influences.

By the way, why do we have to quantify the market-specific value influences numerically? Though there are

various market-specific value influences, they are generally classified into 4 groups in Japan. They are

called the street condition, the traffic approaching condition, the environmental condition and the public

administrative condition.

For example, the width and the kind of the street are the street condition. The character of the closest

railway station and the distance from the station are the traffic approaching condition. The building to

land ratio and the floor area ratio are the public administrative condition. We look into the real data of

these influences and substitute the gap rate for this data. We don't use the real data itself as the gap

rate because the land value does not show the same response to the real data's change.

For example, the ratio of two distances from the closest railway station, 50m and 500m, is expressed in

the pair of two numbers '1 to 10', using the common quantity 50m of the two. But it is not appropriate to

adopt these real data as the gap rate which is used for the explanatory variable. Because the adequate

ratio fitted to the explanatory variable may be expressed even in the pair of two numbers '1 to 20'. So

it is necessary for us to standardize the real data for the gap rate which is fitted to the appraisal.

Only the environmental condition is not shown as the numerical data but as the situation which is called

residential area or commercial area and so on. So instead of the environmental situation we adopt the

quantification method on statistics and make it the numerical rate. In this way all data are replaced

for the gap rates and are used to calculate the land value.

However, even if the gap rate is appropriate in the same value influence, it does not indicate how much

each condition influences the whole market-specific value. The multiple regression analysis is very useful

in solving this problem.

4. The multiple regression analysis and market-specific value influences

Though the multiple regression analysis is different from our appraisal, the analysis will be helpful to

us. The multiple regression equation is a linear expression. Replace all variables with logarithms. As the

linear expression means addition, it is easy to change addition to multiplication by changing all

variables with the logarithms. The land value is generally considered the multiplication of the value

influences. So it is necessary to change addition to multiplication. That is to say, it is very convenient

to compare the variables replaced by the logarithms with the value influences. The multiple regression

analysis will not be a good guide to our appraisal until the linear expression is replaced by the

multiplication.

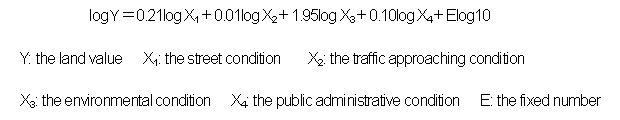

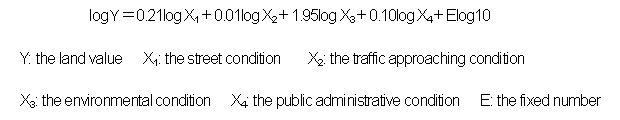

According to the multiple regression analysis, the market-specific value influences on Shirahama town are

shown as the following equation. In the equation each variable is replaced with a common logarithm.

3. The gap rate

When we appraise a piece of real estate, we must analyze the value influences of the real estate. Above

all, while performing an analysis of the subject neighborhood, we must grasp the market-specific value

influences and quantify them numerically. The quantitative analysis is expressed as the gap rate of the

market-specific value influences which are useful to apply the appraisal approach, especially the sales

comparison approach.

The land value is generally considered the product of various value influences. Value influences are

divided into general value influences, market-specific value influences and property-specific influences.

By the way, why do we have to quantify the market-specific value influences numerically? Though there are

various market-specific value influences, they are generally classified into 4 groups in Japan. They are

called the street condition, the traffic approaching condition, the environmental condition and the public

administrative condition.

For example, the width and the kind of the street are the street condition. The character of the closest

railway station and the distance from the station are the traffic approaching condition. The building to

land ratio and the floor area ratio are the public administrative condition. We look into the real data of

these influences and substitute the gap rate for this data. We don't use the real data itself as the gap

rate because the land value does not show the same response to the real data's change.

For example, the ratio of two distances from the closest railway station, 50m and 500m, is expressed in

the pair of two numbers '1 to 10', using the common quantity 50m of the two. But it is not appropriate to

adopt these real data as the gap rate which is used for the explanatory variable. Because the adequate

ratio fitted to the explanatory variable may be expressed even in the pair of two numbers '1 to 20'. So

it is necessary for us to standardize the real data for the gap rate which is fitted to the appraisal.

Only the environmental condition is not shown as the numerical data but as the situation which is called

residential area or commercial area and so on. So instead of the environmental situation we adopt the

quantification method on statistics and make it the numerical rate. In this way all data are replaced

for the gap rates and are used to calculate the land value.

However, even if the gap rate is appropriate in the same value influence, it does not indicate how much

each condition influences the whole market-specific value. The multiple regression analysis is very useful

in solving this problem.

4. The multiple regression analysis and market-specific value influences

Though the multiple regression analysis is different from our appraisal, the analysis will be helpful to

us. The multiple regression equation is a linear expression. Replace all variables with logarithms. As the

linear expression means addition, it is easy to change addition to multiplication by changing all

variables with the logarithms. The land value is generally considered the multiplication of the value

influences. So it is necessary to change addition to multiplication. That is to say, it is very convenient

to compare the variables replaced by the logarithms with the value influences. The multiple regression

analysis will not be a good guide to our appraisal until the linear expression is replaced by the

multiplication.

According to the multiple regression analysis, the market-specific value influences on Shirahama town are

shown as the following equation. In the equation each variable is replaced with a common logarithm.

Even if each variable is expressed by the common logarithm, there is not any change in the tendency. That

is to say, if the explanatory variables are directly proportioned to the dependent variable, replaced

logarithms also have the same tendency. The coefficient of determination is also 0.91 and the accuracy of

this equation is very high.

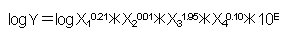

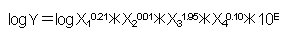

Let's change this equation from the addition into the multiplication.

Even if each variable is expressed by the common logarithm, there is not any change in the tendency. That

is to say, if the explanatory variables are directly proportioned to the dependent variable, replaced

logarithms also have the same tendency. The coefficient of determination is also 0.91 and the accuracy of

this equation is very high.

Let's change this equation from the addition into the multiplication.

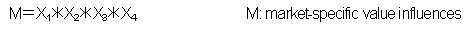

This equation closely resembles the following one which we generally use in case of the appraisal.

This equation closely resembles the following one which we generally use in case of the appraisal.

ü@ü@ü@ü@ ü@

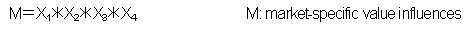

Let's pay attention to the difference of these two equations. Except for the point being made by the

logarithms, it is the most different point that each condition has a different exponent in this

multiplication which is replaced from the multiple regression equation. The left side of both equations is

also different, but as the market-specific influences are a part of the land value, we don't take care of

the difference. These exponents are called partial regression coefficients in the linear regression equation.

This partial regression coefficient shows the contribution to the dependent variable of each explanatory

variable.ü@Since each explanatory variable means a group of the market-specific value influences, try to

examine each group closely. The partial regression coefficient of the street condition, the traffic

approaching condition and the public administrative condition is very small. On the other hand the

environmental condition's is very large. What does this mean?

This means that the street condition, the traffic approaching condition and the public administrative

condition are not as important as the environmental condition in the market-specific value influences.

The environmental condition has the most influence on the market-specific value. Of course, this is true

of Shirahama town which belongs to the rural area and is not necessarily true of any municipalities.

Why does the traffic approaching condition have only a small impact on the market-specific value

influences? It seems because of motorization. The importance of the closest railway station has become

smaller and smaller in recent years. Almost every home in the local area has a car and it is more convenient

to travel by car. It is also one of the reasons why there are fewer railway systems.

The commercial area in front of the railway station doesn't prosper as it did in the past. In the days

when the car was uncommon, the area prospered mainly because of the souvenir stores. In those days the

area functioned as the commercial center of the town. The closer the subject place was to the railway

station, the more business it had. This tendency is no longer true. This is one of the reasons that the

traffic approaching condition has only a small impact on the market-specific value influences.

ü@ü@ü@ü@ ü@

Let's pay attention to the difference of these two equations. Except for the point being made by the

logarithms, it is the most different point that each condition has a different exponent in this

multiplication which is replaced from the multiple regression equation. The left side of both equations is

also different, but as the market-specific influences are a part of the land value, we don't take care of

the difference. These exponents are called partial regression coefficients in the linear regression equation.

This partial regression coefficient shows the contribution to the dependent variable of each explanatory

variable.ü@Since each explanatory variable means a group of the market-specific value influences, try to

examine each group closely. The partial regression coefficient of the street condition, the traffic

approaching condition and the public administrative condition is very small. On the other hand the

environmental condition's is very large. What does this mean?

This means that the street condition, the traffic approaching condition and the public administrative

condition are not as important as the environmental condition in the market-specific value influences.

The environmental condition has the most influence on the market-specific value. Of course, this is true

of Shirahama town which belongs to the rural area and is not necessarily true of any municipalities.

Why does the traffic approaching condition have only a small impact on the market-specific value

influences? It seems because of motorization. The importance of the closest railway station has become

smaller and smaller in recent years. Almost every home in the local area has a car and it is more convenient

to travel by car. It is also one of the reasons why there are fewer railway systems.

The commercial area in front of the railway station doesn't prosper as it did in the past. In the days

when the car was uncommon, the area prospered mainly because of the souvenir stores. In those days the

area functioned as the commercial center of the town. The closer the subject place was to the railway

station, the more business it had. This tendency is no longer true. This is one of the reasons that the

traffic approaching condition has only a small impact on the market-specific value influences.

You may be surprised by the fact that the ratio of the street condition in the market specific value

influences is smaller than you think. By Building Standard Law of Japan, a building can not be built in

the area if the width of the road is less than 4 meters. The gap rate must be very large according to

whether the width of the road is more or less than 4m in theory. But in this analysis it is not really

very large. The reason is considered that a part of the influence by the width of the road is included in

the environmental condition.

Though it is not so much as multicollinearity, there are few places in which the width of the road is

more than 4m in the farmhouse area in Japan. On the other hand, in the usual residence area where there

are many detached houses most of the houses face the street where the width is equal to 4 meters or more.

For example, suppose that there is a 1 point gap in the traffic approaching condition and there is also

a 1 point gap in the environmental condition. We tend to take it for granted that there is a 1 point gap

in either condition and each gap is on a level. However, as stated above, each gap is not equal in

Shirahama town because the ratio of the traffic approaching condition in the market-specific value

influences is much smaller than that of the environmental condition. We often compare an influence with

another one without noticing this difference.

5. The general condition of Shirahama town

If we misunderstand the market-specific value influences, it has a bad effect on the general value

influences and the property-specific value influences. So I will show you the characteristics of the

general influences and the property-specific value influences on this town.

There are a lot of leisure homes, resort condominiums and hot spring hotels as well as a large-scale

theme park which has giant pandas in this town. This town had been very busy as a tourist resort. But

since the collapse of the bubble economy this business has declined. Large Japanese companies used to

have many resort houses in this town. Now most of these houses have been sold and there are some

bankrupted hotels. Although there are some surviving hotels, they don't contribute any efforts to

reinvigorate the local economy. The guests of the hotels can receive every sort of service from the

hotels themselves. So restaurants and amusement facilities in the town don't have a lot of customers.

Shopping stores are open for business, but are doing virtually none at all even in peak season.

There are representative lands for publication of land price in Japan. There is one of them in the main

commercial area in this town. The transition of the land price is the following.

You may be surprised by the fact that the ratio of the street condition in the market specific value

influences is smaller than you think. By Building Standard Law of Japan, a building can not be built in

the area if the width of the road is less than 4 meters. The gap rate must be very large according to

whether the width of the road is more or less than 4m in theory. But in this analysis it is not really

very large. The reason is considered that a part of the influence by the width of the road is included in

the environmental condition.

Though it is not so much as multicollinearity, there are few places in which the width of the road is

more than 4m in the farmhouse area in Japan. On the other hand, in the usual residence area where there

are many detached houses most of the houses face the street where the width is equal to 4 meters or more.

For example, suppose that there is a 1 point gap in the traffic approaching condition and there is also

a 1 point gap in the environmental condition. We tend to take it for granted that there is a 1 point gap

in either condition and each gap is on a level. However, as stated above, each gap is not equal in

Shirahama town because the ratio of the traffic approaching condition in the market-specific value

influences is much smaller than that of the environmental condition. We often compare an influence with

another one without noticing this difference.

5. The general condition of Shirahama town

If we misunderstand the market-specific value influences, it has a bad effect on the general value

influences and the property-specific value influences. So I will show you the characteristics of the

general influences and the property-specific value influences on this town.

There are a lot of leisure homes, resort condominiums and hot spring hotels as well as a large-scale

theme park which has giant pandas in this town. This town had been very busy as a tourist resort. But

since the collapse of the bubble economy this business has declined. Large Japanese companies used to

have many resort houses in this town. Now most of these houses have been sold and there are some

bankrupted hotels. Although there are some surviving hotels, they don't contribute any efforts to

reinvigorate the local economy. The guests of the hotels can receive every sort of service from the

hotels themselves. So restaurants and amusement facilities in the town don't have a lot of customers.

Shopping stores are open for business, but are doing virtually none at all even in peak season.

There are representative lands for publication of land price in Japan. There is one of them in the main

commercial area in this town. The transition of the land price is the following.

In Japan a tourist resort always includes a spa because Japanese like it. In this town there have been

many spas of very good quality, leisure homes with hot spring bathrooms used to be sold frequently. But

recently the sales have dropped off. Since the collapse of the bubble economy people have been very

careful to find spas of good quality.

It is very important for us to look into the property-specific value influences of the leisure home area.

The influence which has a negative impact on the value of the general residence area sometimes becomes a

positive advantage for the leisure home area. For example, it is an advantage for the leisure home if the

view of the leisure home is beautiful. Even if it is located close to the sea and may be flooded when a

storm comes, someone may buy it because he can easily go in and out by boat.

Because of the many inns and hotels, the commercial area in this town is declining, but the effort to

reinvigorate the local economy is being made slowly. For example the fisherman's cooperative of this town

has opened a store serving both as a restaurant and a gift shop and a spa intended for the day tripper has

also been started. Recently Nanki-shirahama airport has begun to accept flights from foreign countries.

The expressway from Osaka has been extended near here. In the future this town will be the base not only

for traveling but also for sightseeing along the south of the Kii Peninsula which includes World Heritage

Sites.

6. The conclusion

The general value influences and property-specific value influences in the resort area are full of

variety and are apt to be affected by business trends. So it is very important to understand the

market-specific value influences in analyzing the value influences.

It is common for us to replace the gap of each influence in each condition with the gap rate by our

intuition. But, as mentioned above, we must pay attention to the different exponent (or coefficient) of

each condition. This exponent (or coefficient) may be called the weight of each influence.

Economics say that utilities can not be counted but can be only expressed as an ordinal number.

Nevertheless we need the utilities shown as a cardinal number in order to appraise the land. Therefore we

substitute the cardinal gap rate for the ordinal value influences. But we must pay attention to the fact

that each influence has a different weight even if each gap rate is the same. It is as if the volume was

the same at a glance but the weight was different when you compared a spoonful of water with a spoonful of

milk.

In this analysis of Shirahama town the environmental condition has the most weight in the market-specific

value influences. It is not too much to say that the land value depends on the environmental condition if

there is not much gap of the land price in a city or town.

Generally speaking, the broader the width of the road is or the closer the railway station is, the more

the land value may increase. So when we substitute the numerical gap rate for the real data of these

influences, it may be correct in the condition. But we must recognize how much weight the condition has

in the total market-specific value influences. So we need to apply the multiple regression analysis.

Recently personal computers have come into wide use and various functions of the spreadsheet software

have also been improved. So we can use the statistical analysis which includes this multiple regression

analyses. And we must recognize the character of the marker-specific value influences in the area where

the subject property exists and make the most of the appraisal opportunities.

The multiple regression analysis is suitable for not only understanding market-specific value influences

but also judging whether the evaluation of many spots is well-balanced. Please try to use the multiple

regression analysis in your appraisal.

There is a proverb in English "You cannot see the city for the houses".

In Japan a tourist resort always includes a spa because Japanese like it. In this town there have been

many spas of very good quality, leisure homes with hot spring bathrooms used to be sold frequently. But

recently the sales have dropped off. Since the collapse of the bubble economy people have been very

careful to find spas of good quality.

It is very important for us to look into the property-specific value influences of the leisure home area.

The influence which has a negative impact on the value of the general residence area sometimes becomes a

positive advantage for the leisure home area. For example, it is an advantage for the leisure home if the

view of the leisure home is beautiful. Even if it is located close to the sea and may be flooded when a

storm comes, someone may buy it because he can easily go in and out by boat.

Because of the many inns and hotels, the commercial area in this town is declining, but the effort to

reinvigorate the local economy is being made slowly. For example the fisherman's cooperative of this town

has opened a store serving both as a restaurant and a gift shop and a spa intended for the day tripper has

also been started. Recently Nanki-shirahama airport has begun to accept flights from foreign countries.

The expressway from Osaka has been extended near here. In the future this town will be the base not only

for traveling but also for sightseeing along the south of the Kii Peninsula which includes World Heritage

Sites.

6. The conclusion

The general value influences and property-specific value influences in the resort area are full of

variety and are apt to be affected by business trends. So it is very important to understand the

market-specific value influences in analyzing the value influences.

It is common for us to replace the gap of each influence in each condition with the gap rate by our

intuition. But, as mentioned above, we must pay attention to the different exponent (or coefficient) of

each condition. This exponent (or coefficient) may be called the weight of each influence.

Economics say that utilities can not be counted but can be only expressed as an ordinal number.

Nevertheless we need the utilities shown as a cardinal number in order to appraise the land. Therefore we

substitute the cardinal gap rate for the ordinal value influences. But we must pay attention to the fact

that each influence has a different weight even if each gap rate is the same. It is as if the volume was

the same at a glance but the weight was different when you compared a spoonful of water with a spoonful of

milk.

In this analysis of Shirahama town the environmental condition has the most weight in the market-specific

value influences. It is not too much to say that the land value depends on the environmental condition if

there is not much gap of the land price in a city or town.

Generally speaking, the broader the width of the road is or the closer the railway station is, the more

the land value may increase. So when we substitute the numerical gap rate for the real data of these

influences, it may be correct in the condition. But we must recognize how much weight the condition has

in the total market-specific value influences. So we need to apply the multiple regression analysis.

Recently personal computers have come into wide use and various functions of the spreadsheet software

have also been improved. So we can use the statistical analysis which includes this multiple regression

analyses. And we must recognize the character of the marker-specific value influences in the area where

the subject property exists and make the most of the appraisal opportunities.

The multiple regression analysis is suitable for not only understanding market-specific value influences

but also judging whether the evaluation of many spots is well-balanced. Please try to use the multiple

regression analysis in your appraisal.

There is a proverb in English "You cannot see the city for the houses".

|

is the sum of squares of the residual. The lesser this

is, the closer the coefficient of determination to 1 and the more suitable this regression equation is

for the analysis. In this way it is called the least squares method to seek the regression equation as

the coefficient of determination is closer to 1. The multiple regression analysis is this application.

In this simple regression analysis the explanatory variable is only one but in the multiple regression

analysis the variables become more than one. The multiple regression equation is expressed as follows.

is the sum of squares of the residual. The lesser this

is, the closer the coefficient of determination to 1 and the more suitable this regression equation is

for the analysis. In this way it is called the least squares method to seek the regression equation as

the coefficient of determination is closer to 1. The multiple regression analysis is this application.

In this simple regression analysis the explanatory variable is only one but in the multiple regression

analysis the variables become more than one. The multiple regression equation is expressed as follows.